What Is a Mother-in-Law Suite? Legal Overview

A mother-in-law suite, also known as an accessory dwelling unit (ADU), granny flat, or in-law apartment, is a self-contained living space within or attached to a primary residential property. This supplementary dwelling typically includes a bedroom, bathroom, kitchen, and living area, designed to accommodate elderly parents, adult children, or other family members while maintaining relative independence. The rising popularity of multigenerational housing has made understanding the legal framework surrounding these structures essential for homeowners considering this arrangement.

The legal landscape governing mother-in-law suites varies significantly by jurisdiction, involving zoning regulations, building codes, tax implications, and property ownership considerations. Before constructing or converting space into a mother-in-law suite, property owners must navigate complex municipal requirements and potential restrictions. This comprehensive guide examines the legal aspects of mother-in-law suites, helping homeowners understand their rights, obligations, and potential liabilities.

Definition and Types of Mother-in-Law Suites

A mother-in-law suite is legally classified as an accessory dwelling unit (ADU) in most jurisdictions. The National Association of Home Builders defines ADUs as independent residential units located on single-family residential lots that contain basic living facilities including sleeping, cooking, and sanitation areas. These units serve as secondary dwellings on properties primarily zoned for single-family residential use.

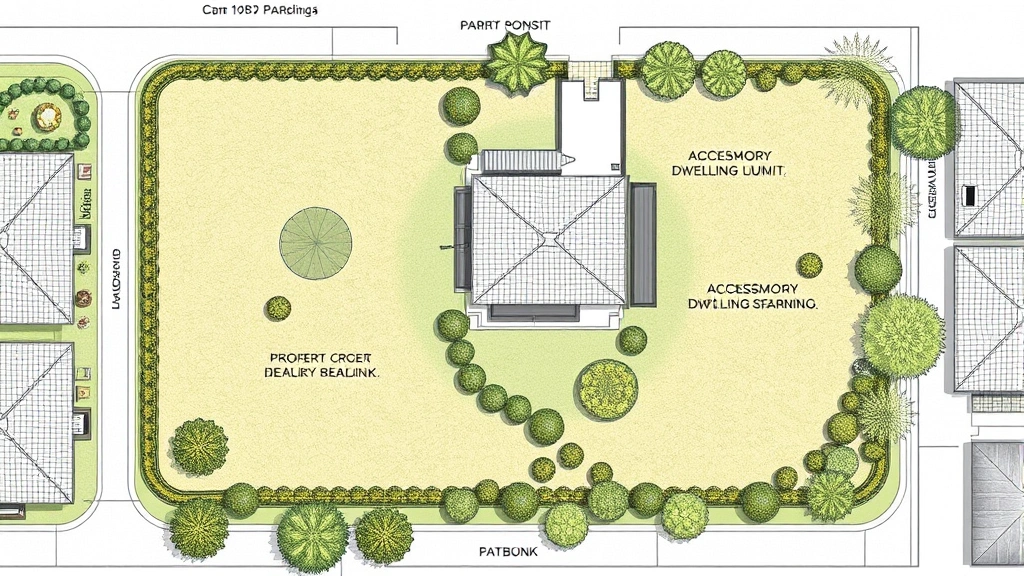

Mother-in-law suites exist in several configurations, each with distinct legal implications. An attached ADU shares one or more walls with the primary residence, such as a finished basement apartment or converted garage space. A detached ADU stands independently on the property, typically a separate cottage or converted accessory building. An internal ADU occupies space within the main house, such as a finished basement or upper-floor apartment with separate entrance. The legal treatment of these variations differs substantially, with attached units often facing fewer regulatory hurdles than detached structures.

Understanding your specific ADU configuration is crucial because zoning ordinances frequently distinguish between these types. Some municipalities permit internal conversions while prohibiting detached structures, or vice versa. The distinction affects permitting processes, tax assessments, and potential resale complications. Before proceeding with any mother-in-law suite project, consult local planning and zoning departments to determine which configurations comply with existing regulations.

Zoning Laws and Municipal Regulations

Zoning regulations represent the primary legal barrier to constructing or converting space into a mother-in-law suite. Traditionally, most American municipalities enforced single-family zoning, which explicitly prohibited multiple dwelling units on residential lots. However, recent years have witnessed significant zoning reform, with many cities and states legalizing ADUs to address housing shortages and affordability crises.

State-level ADU legalization has accelerated dramatically. California pioneered this movement with legislation permitting ADUs statewide, effectively overriding local restrictive zoning ordinances in many cases. Oregon, Washington, Minnesota, and other states have similarly enacted ADU-friendly legislation. However, even in ADU-friendly states, local municipalities retain authority to impose restrictions such as owner-occupancy requirements, unit size limitations, parking requirements, or setback specifications.

Your local zoning code governs whether mother-in-law suites are permitted, and under what conditions. Common restrictions include:

- Owner-occupancy requirements: One unit must be owner-occupied, typically the primary residence

- Unit size limitations: ADUs may be capped at 750 square feet or a percentage of the primary residence

- Lot size minimums: Properties must meet minimum acreage before ADUs are permitted

- Setback and separation requirements: Specific distances from property lines and neighboring structures

- Parking mandates: Additional parking spaces may be required for the secondary unit

- Height restrictions: ADUs may face stricter height limitations than primary residences

Contact your local planning and zoning department to obtain current ADU regulations. Many municipalities maintain online zoning codes accessible through their websites. Request a zoning verification letter confirming whether your property permits mother-in-law suite development under current ordinances. This documentation becomes critical when selling property or applying for permits. Non-compliant structures create serious legal exposure, including code enforcement actions, fines, and potential demolition orders.

Building Codes and Permits

Even in jurisdictions permitting ADUs, constructing or converting space into a mother-in-law suite requires obtaining proper building permits and ensuring compliance with applicable building codes. The International Building Code (IBC) and International Residential Code (IRC) establish minimum standards for residential construction, including requirements specific to accessory dwelling units.

Building code compliance addresses critical safety and habitability standards. Mother-in-law suites must include:

- Adequate egress windows or doors meeting emergency exit requirements

- Separate utility meters or clearly demarcated utility systems

- Compliant electrical systems with dedicated circuits and breaker panels

- Proper ventilation, heating, and cooling systems

- Sanitary plumbing with code-compliant fixtures

- Fire-rated separation walls between units (for attached ADUs)

- Smoke and carbon monoxide detection systems

- ADA accessibility compliance for doorways and bathrooms

Obtaining permits involves submitting detailed architectural plans, site plans, and engineering drawings to your local building department. Permit applications typically require engineer or architect certification that designs comply with applicable codes. Building inspections occur at various construction stages: foundation, framing, electrical rough-in, plumbing rough-in, and final inspection. Unpermitted conversions create substantial legal problems, including:

- Inability to legally rent the space

- Insurance claim denials for damages occurring in unpermitted areas

- Code enforcement violations and fines

- Difficulty selling property with illegal units

- Lender refusal to finance properties with unpermitted structures

The permitting process requires patience and expense, but legitimate permits provide legal protection and ensure the mother-in-law suite meets safety standards. Budget typically ranges from $5,000 to $20,000 for permits and inspections, depending on jurisdiction and project complexity.

Tax Implications and Property Assessment

Adding a mother-in-law suite affects property taxes and assessment values. When you create additional residential space, your property’s assessed value typically increases, resulting in higher property tax bills. Assessors examine the additional square footage, number of dwelling units, and income-generating potential when recalculating assessments.

The tax impact varies significantly based on whether the ADU is rented or occupied by family members at no charge. If you rent the mother-in-law suite, rental income becomes taxable income and must be reported on your federal tax return. You may deduct certain expenses related to the rental unit, including mortgage interest, property taxes, insurance, maintenance, utilities, and depreciation. However, depreciation deductions create complications when selling the property, as depreciation recapture may trigger capital gains taxation.

Some jurisdictions offer property tax exemptions or reductions for ADUs, particularly if owner-occupied or used for family members. California Proposition 15 and similar legislation in other states provide temporary tax relief for newly constructed ADUs. Research your state and local tax treatment before proceeding with development.

Consult a tax professional regarding your specific situation. The interaction between ADU development, rental income, depreciation, and property taxes involves complex calculations that require expert guidance. Improper tax treatment creates audit risk and potential penalties.

Insurance Considerations

Standard homeowners insurance policies typically cover only the primary residence and may not provide adequate coverage for a mother-in-law suite, particularly if rented to non-family members. Insurance companies view additional dwelling units as increased liability exposure and may require policy modifications.

If the mother-in-law suite is occupied by family members at no charge, your standard homeowners policy may provide coverage with a simple endorsement. However, if you rent the unit, most insurers require a separate dwelling fire policy or modified homeowners policy with rental coverage. Rental units expose you to additional liability risks, including tenant injuries, property damage claims, and potential premises liability litigation.

Insurance considerations include:

- Liability coverage limits: Ensure adequate limits for potential injuries occurring on your property

- Property damage coverage: Covers damage to the mother-in-law suite structure and fixtures

- Loss of rent coverage: Protects rental income if the unit becomes uninhabitable

- Tenant occupancy clauses: Some policies restrict coverage if tenants lack family relationship to the owner

- Disclosure requirements: You must disclose the ADU to your insurer; failure to disclose may void coverage

Contact your insurance agent immediately when planning a mother-in-law suite. Undisclosed rental units create serious problems if insurance claims arise. Some claims have been denied entirely because insureds failed to disclose additional dwelling units to their carriers.

Ownership and Tenancy Issues

If you intend to rent the mother-in-law suite to family members, establishing clear written agreements protects both parties. Even family rentals should include written lease agreements specifying rent amounts, lease duration, maintenance responsibilities, and termination procedures. Written agreements prevent misunderstandings and provide legal documentation if disputes arise.

If renting to non-family members, landlord-tenant law applies fully. You must comply with all applicable fair housing laws, which prohibit discrimination based on protected characteristics including race, color, religion, national origin, sex, familial status, and disability. Fair housing violations can result in significant damages and attorney’s fees awards. Familiarize yourself with federal fair housing requirements and your state’s landlord-tenant statutes.

Tenancy laws address crucial issues including:

- Security deposit limits and handling requirements

- Lease term specifications and renewal procedures

- Rent increase limitations and notice requirements

- Eviction procedures and timelines

- Habitability standards and maintenance obligations

- Tenant privacy rights and landlord entry restrictions

State and local landlord-tenant laws vary substantially. Some jurisdictions impose strict rent control, while others permit market-rate increases. Eviction procedures range from straightforward to extremely tenant-protective. Research your jurisdiction’s specific requirements before renting mother-in-law suites. Many states require landlords to complete certification courses or consult with attorneys regarding compliance obligations.

HOA Restrictions and Covenants

If your property is located within a homeowners association (HOA), covenants, conditions, and restrictions (CC&Rs) may prohibit mother-in-law suites or impose specific requirements. HOA restrictions sometimes predate state ADU legalization and explicitly forbid accessory dwelling units or additional structures on residential lots.

Even if state law permits ADUs, HOA restrictions may remain enforceable. California courts have addressed this tension, generally holding that HOA restrictions survive state ADU legalization unless the specific property qualifies for statutory exemptions. Some states have enacted legislation limiting HOA authority to restrict ADUs, but many jurisdictions have not addressed this issue.

Before proceeding with mother-in-law suite development in HOA communities, review your CC&Rs thoroughly and contact your HOA board. Some associations may be willing to amend restrictions or grant variances, while others strictly enforce prohibitions. Proceeding without HOA approval in restrictive communities creates legal exposure, including injunctions requiring removal of non-compliant structures.

If your HOA prohibits ADUs, you may have limited options. Some jurisdictions permit challenging HOA restrictions as unreasonable or contrary to public policy, but litigation is expensive and uncertain. Request formal clarification from your HOA regarding ADU policies before investing in mother-in-law suite development.

Liability and Legal Protections

Operating a rental mother-in-law suite creates potential liability for injuries occurring on your property. Premises liability law holds property owners responsible for maintaining reasonably safe conditions and warning visitors of known hazards. Slip-and-fall accidents, structural failures, or injuries resulting from property defects can trigger substantial liability claims.

Liability protections include adequate homeowners insurance with appropriate coverage limits, maintaining the property in safe condition, conducting regular inspections, and promptly addressing maintenance issues. Document all repairs and maintenance activities. Establish clear tenant responsibilities regarding property upkeep and require tenants to report maintenance concerns immediately.

Consider whether creating a separate legal entity to hold the property would provide liability protection. Some property owners establish limited liability companies (LLCs) to own rental properties, potentially shielding personal assets from liability claims. However, LLC protection is not absolute and requires maintaining proper formalities and separation between personal and business finances. Consult with a business attorney regarding whether entity formation makes sense for your specific situation.

Tenant screening protects against problems before they arise. Conduct background checks, verify employment and income, contact previous landlords, and obtain rental references. Thorough screening reduces the likelihood of problem tenants causing property damage or creating liability situations. However, ensure screening procedures comply with fair housing laws and do not discriminate against protected classes.

If disputes arise with tenants, consult an attorney experienced in landlord-tenant law. Attempting to self-help evictions or taking illegal actions against tenants creates substantial liability. Proper legal procedures, though time-consuming and expensive, protect your interests and avoid creating additional legal exposure.

FAQ

Can I legally rent a mother-in-law suite?

Renting a mother-in-law suite depends on local zoning laws, HOA restrictions, and building code compliance. If your property zoning permits ADUs, the unit is properly permitted and inspected, and you comply with landlord-tenant laws, rental is typically legal. However, zoning regulations in your jurisdiction may restrict rental or require specific conditions like owner-occupancy. Check local regulations and HOA documents before renting.

Do I need a permit to build a mother-in-law suite?

Yes, virtually all jurisdictions require building permits for mother-in-law suite construction or conversion. Unpermitted work violates building codes, creates insurance problems, and complicates property sales. Obtain permits before beginning any construction. The permitting process ensures the structure meets safety standards and complies with zoning regulations. Budget time and expense for the full permitting process, which typically requires architectural plans and multiple inspections.

How does a mother-in-law suite affect property taxes?

Adding a mother-in-law suite typically increases your property’s assessed value, resulting in higher property taxes. The increase depends on the suite’s size, location, and local assessment practices. If you rent the suite, rental income is taxable. You may deduct certain expenses, but depreciation deductions create complications when selling. Some jurisdictions offer temporary tax relief for newly constructed ADUs. Consult a tax professional regarding your specific situation.

What insurance do I need for a rental mother-in-law suite?

Standard homeowners insurance typically does not adequately cover rental units. You need either a separate dwelling fire policy or a modified homeowners policy with rental coverage. Your insurer must know about the rental unit; undisclosed rentals may result in claim denial. Adequate liability coverage protects against injuries occurring on your property. Contact your insurance agent to determine appropriate coverage before renting.

Can HOA restrictions prevent me from building a mother-in-law suite?

Yes, HOA CC&Rs can prohibit mother-in-law suites even in jurisdictions where state law permits them. While some states have enacted legislation limiting HOA authority to restrict ADUs, many jurisdictions have not addressed this issue. Review your CC&Rs and contact your HOA board before proceeding. Some associations may grant variances or amend restrictions, while others strictly enforce prohibitions. Proceeding without HOA approval in restrictive communities creates legal exposure.

What are the main legal requirements for a compliant mother-in-law suite?

Compliant mother-in-law suites must satisfy zoning regulations, building codes, and permitting requirements. Key requirements include proper egress, separate utilities, compliant electrical and plumbing systems, fire-rated separation walls (for attached units), smoke and carbon monoxide detectors, and ADA accessibility compliance. The suite must pass building inspections at multiple stages. Consult your local building department regarding specific requirements in your jurisdiction.